To calculate a property’s cash flow, you simply take all of the inflows and subtract all of the cash outflows during the relevant time period. For the calculation of cash flow, it is irrelevant if the cash item is considered a taxable income or not; and whether cash outflows are tax deductible. An example would be the treatment of mortgage payments. For cash flow purposes the entire mortgage payment is counted while for tax purposes only the interest portion is actually deductible. Further, cash flow does not include depreciation expenses as they are not actual cash expenses.

When you speak about cash flow you usually mean cash flow before taxes (CFBT) which does not take into account the property's impact on the owner's income tax liability. Cash flow after taxes (CFAT) is the CFBT less any tax liability that arises from the operation of the property.

You can think of cash flow as the equivalent of the property's checkbook. It accounts for all of the money that flows in and all that flows out. Inflows can include rent, loan proceeds, and interest on bank accounts. Outflows can include debt payments, operating expenses, and capital additions.

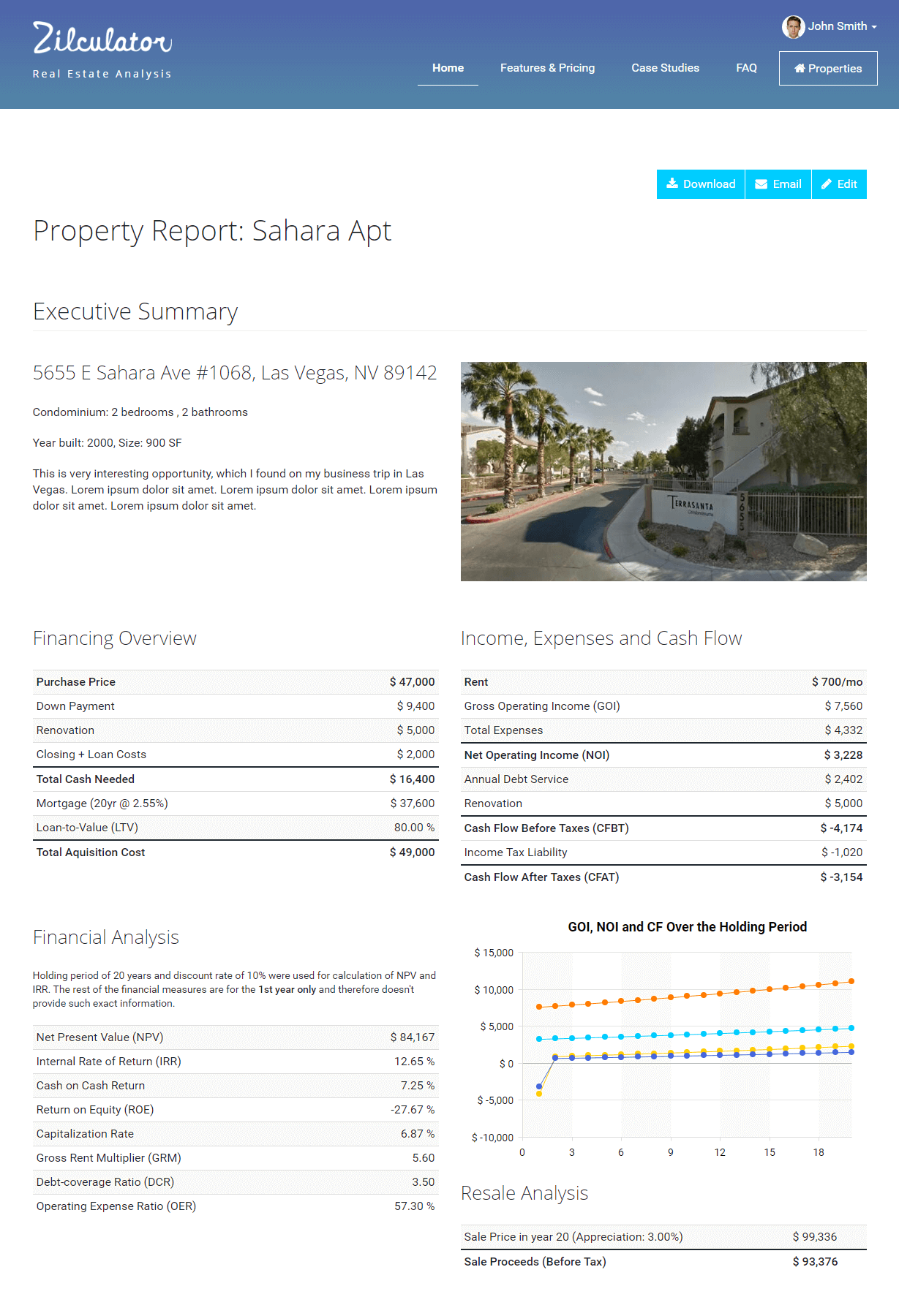

Zilculator helps real estate professionals calculate both cash flow before and after taxes for up to 30-year holding period. Never use a spreadsheet again! Analyze your own property or create investment reports for your clients.

- Professional-grade branded investment reports

- Loading data from MLS®, Zillow®, and Rentometer Pro®

- Sales and Rental comps

How to Calculate Cash Flow of a Rental Property

- Calculate net operating income - it equals gross scheduled income less vacancy loss and operating expenses.

- Debt service is the total loan payment, including both interest and principal.

- Capital expenditures are additions having a useful life of more than one year or improvements prolonging the life of the property.

- Calculate cash flow before taxes using this formula:

Excel Spreadsheet Example

We prepared a simple example and calculation of a rental property cash flow in an excel spreadsheet file. You can download the file, input your own numbers and calculate results in no time. The only thing we ask in return is for you to like our facebook page or follow us on twitter.