You should know about the break-even ratio (BER) because it is a benchmark often used by lenders when underwriting commercial mortgages. Its purpose is to estimate how vulnerable a property is to defaulting on its debt should rental income decline. There is an old saying that when your outgo exceeds your income, your upkeep will be your downfall.

Usually lenders look for a BER of 85% or less. If occupancy rates in a particular market are exceptionally low and your revenue is therefore a bit less certain, lenders may require a BER that is several percentage points less than the average occupancy rate.

We recommend you to review also Debt Coverage Ratio in Zilculator's Real Estate Analysis Metrics section, because it is also a favored metric used by many lenders.

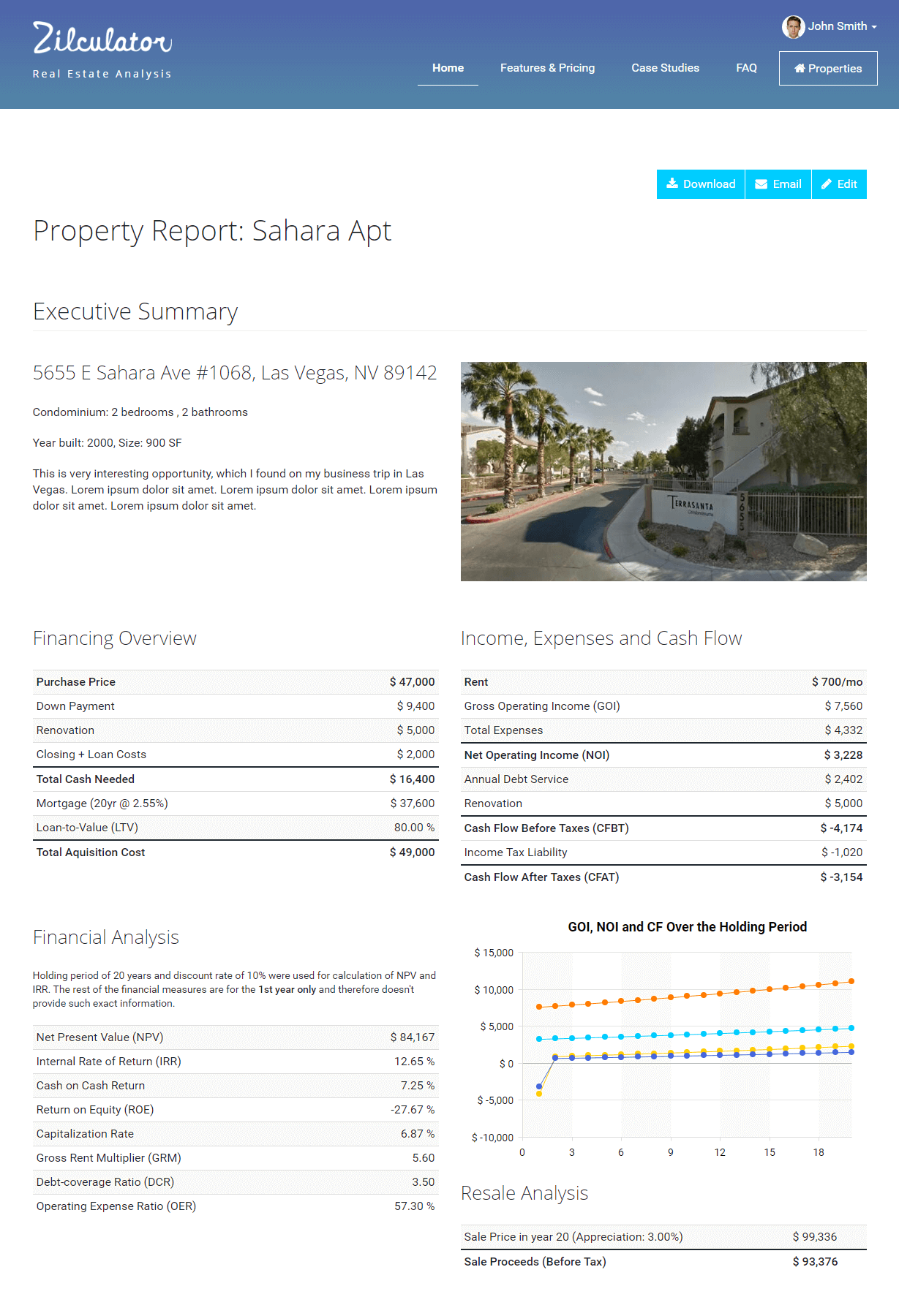

Zilculator helps real estate professionals generate break even analysis quicker. Never use a spreadsheet again! Analyze your own property or create investment reports for your clients.

- Professional-grade branded investment reports

- Loading data from MLS®, Zillow®, and Rentometer Pro®

- Sales and Rental comps

How to Calculate Break-Even Ratio

- Add the annual debt service, which is the total of mortgage payments for the year AND operating expenses.

- Divide by the annual gross operating income (GOI) of the property.

Excel Spreadsheet Example

We prepared a simple example and calculation of a break-even ratio in an excel spreadsheet file. You can download the file, input your own numbers and calculate results in no time. Enter your name and email below to receive your download link.